How much do you need to live the retirement lifestyle you want? It’s a question that’s on the mind of many people as they near their retirement date. Now research suggests that couples need an income of £26,000 to live comfortably, but if you want some luxurious extras, that needs to rise to £41,000.

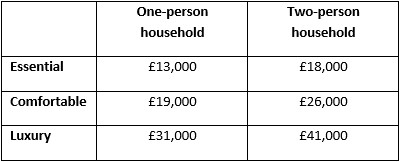

Which? surveyed nearly 7,000 retirees to understand what they spend their money on and how it impacts the lifestyle they lead. The responses were split into three lifestyle categories – essential, comfortable, and luxury. The table below highlights the annual income you’d need to secure these lifestyles.

In retirement, you’re probably hoping to live in comfort, with a few luxuries that mean you’re able to enjoy your time. So how do these sums relate to the lifestyle you can expect?

With a £26,000 a year income, the research suggests a couple will be able to pay for all the essentials, like utility bills, insurance, and household goods, with some left over for treats. This includes a £4,644 budget to spend on European travel and holidays, £1,476 for recreation and leisure, and £1,332 to make charitable donations.

The luxurious budget of £41,000 estimates you’ll have enough to splash out £7,620 a year on long-haul holidays, £4,861 to pay for a new car, and £1,128 on expensive meals out on top of the treats in the comfortable income bracket.

How much do you need to save to secure a £26,000 income in retirement?

The first thing to remember is that your full retirement income is unlikely to come from your personal and workplace pensions. Your State Pension can make up a significant portion and help you cover the essentials.

If you have 35 years of National Insurance Contributions on your record, you’re entitled to the full State Pension. For the 2021/22 tax year, the full State Pension adds up to £9,339.20 a year. Keep in mind that the State Pension Age may not align with when you want to retire. The State Pension Age is currently 66 and will reach 67 by 2028. As a result, if you want to retire before this age, you’ll need to draw a larger income from your pension to meet goals to begin with.

You can supplement your State Pension from a variety of sources, such as your savings, investments, or properties, but pensions will play a central role for most people.

If you have a defined benefit (DB) pension, you’ll know what annual income you can expect when you reach retirement age. However, if you have a defined contribution (DC) pension, your pension forecast will be a lump sum that you’ll need to take an income from throughout retirement. If you have a DC pension, it’s important that you understand how it’ll translate into an income.

Which? estimates that a couple would need pensions worth around £155,000 alongside their State Pension to produce an income of £26,000 when taking a flexible income. This rises to £442,000 to fund a luxury lifestyle. For a one-person household, the figures are £192, 290 and £305,710, respectively.

However, the above calculations make certain assumptions. For example, that your pensions only need to last 20 years. As life expectancy rises, you may spend far longer than two decades in retirement. It also assumes an investment growth rate of 3% a year. If you decide to take a flexible income, investment performance can affect your long-term income and you’ll need to manage withdrawals.

The only way to achieve a reliable income if you have a DC pension is to purchase an annuity. An annuity will pay out a regular income throughout your life and can provide long-term peace of mind. To purchase an annuity, couples would need pensions worth £265,000 and £757,000 to reach the comfortable and luxurious goals, respectively.

How much do you need in retirement?

While the research provides a useful benchmark when saving into a pension, your lifestyle goals may mean a very different income is needed to support you throughout retirement.

Both the comfortable and luxurious budgets include housing payments to cover rent or a mortgage of £3,240 a year. In retirement you may not need to include these in your plan, allowing you to achieve these lifestyles with less money. On the other hand, you may plan to spend more travelling or on your hobbies than the research estimates.

Setting out what you want your retirement to look like, even if it’s years away, can help you set a pension goal that will help you turn your dreams into a reality. If you’d like to discuss what your pension means for your retirement, please contact us.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available.

Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.

Production

Production